- Strong growth in activity: +14.4%

- Slight increase in operating margin: 9,9%

- 10 acquisitions abroad since January 2018

Sharp Business Growth in 2018: +14.4%

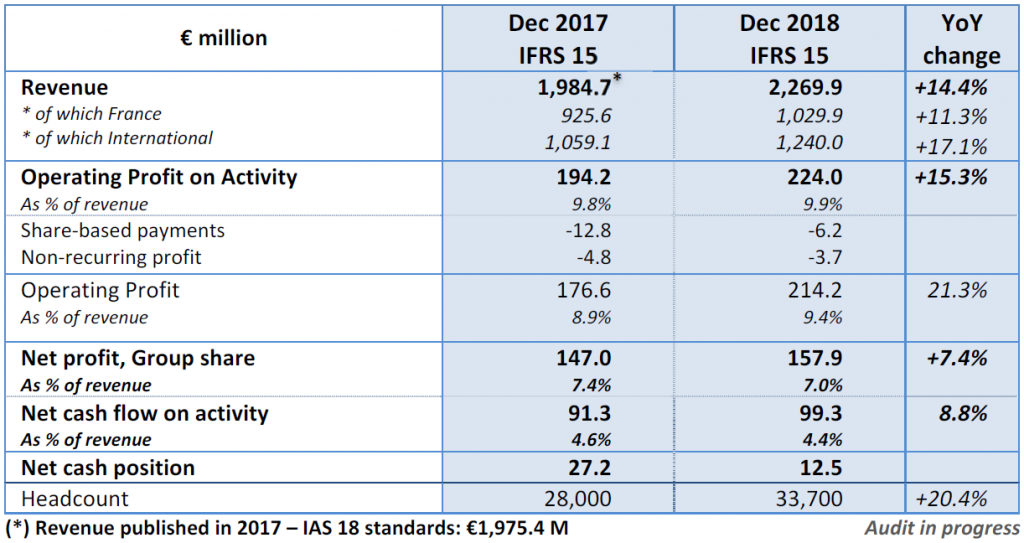

Revenue reaches €2,269.9 M with an increase of 14.4% as compared to 2017. On a like‐for‐like basis and constant exchange rate, the activity increases by 12% (11.3% in France and 12.7% outside France), experiencing sharp growth in the second half of 2018. In all geographical areas – Germany excluded, organic growth has been exceeding 10%.

All business sectors, more especially Aerospace, Automotive, Life Sciences, Defence/Security and Rail/Naval have contributed to accelerate growth.

Operating Profit on Activity: 9.9% of revenue

The operating profit on activity reaches €224 M and accounts for 9.9% of revenue, up by 15.3% as compared to 2017 (9.8% of revenue). Despite significant efforts to strengthen to the Group organizations and the management teams to support its development, ALTEN improved its operating margin. It increased in the second half to reach 10.4% of revenue.

Operating Profit: +21,3%

Operating profit reaches €214.2 M with €6.2 M of IFRS costs dedicated to the implementation of free‐share allocations plans (no cash impact). Non‐recurring profit equals ‐€3.7 M, mainly accounting for acquisition fees, costs linked to tax/social audits and the restructuring of newly acquired companies.

Net Profit, Group Share: +7.4%

The financial result is ‐€1.5 M as opposed to €16.2 M in 2017 (2017 was not standard since it was impacted by the capital gain on the disposal of Ausy shares). After taking into account tax expenses (€61.2 M), as well as the results of earnings from associated companies (€9.1 M) and minority interests (€2.7 M), net profit reaches €157.9 M,

accounting for 7% of revenue.

Net Cash Position: €12.5 M / Gearing: ‐1.3%

Casf flow reaches €242 M (10.7% of revenue), increasing by 18.5% as compared to 2017. Increase in Working Capital Requirement equals €82.2 M, mainly caused by a sharp organic growth, more precisely the growth from the fourth quarter of 2018 that led to an increase in trade receivables of €77 M. After taking into account paid income tax and

Capex (steady and equaling 0.7% of revenue), free cash‐flow reaches €82.5 M accounting for 3.6% of revenue. This enabled self‐financing financial investments and dividends. Net cash position remains positive at end December 2018, reaching €12.5 M.

External Growth: 10 Acquisitions since January 2018:

ALTEN has consolidated its external growth and international footprint with 10 acquisitions outside France

(8 in Europe, 2 in Asia).

– 3 companies in Germany/Austria (annual revenue: €21.5 M, 255 consultants)

– 2 companies in Spain (annual revenue: €27.5 M, 570 consultants)

– 2 companies in Scandinavia (Sweden/Finland) (annual revenue: €18 M, 155 consultants)

– 1 company in the Netherlands (annual revenue: €6.5 M, 90 consultants)

– 1 company in China (annual revenue: €7 M, 160 consultants)

– 1 company in India (annual revenue: €1.3 M, 100 consultants)

Click here to read the Press Release.